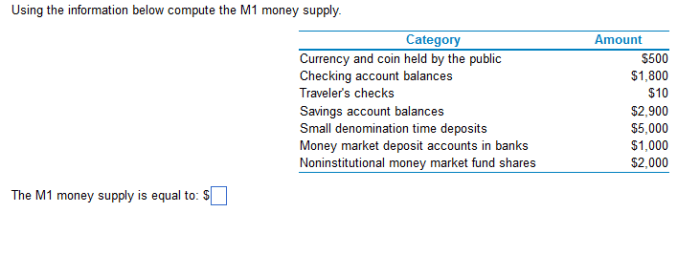

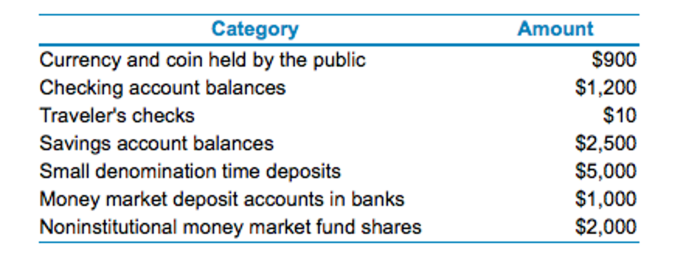

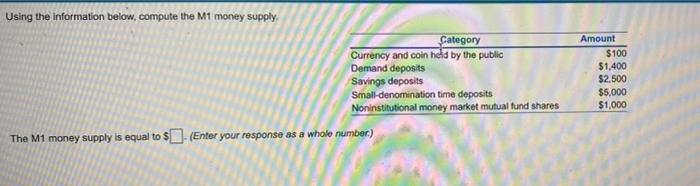

Using the information below compute the m1 money supply. – Using the information below, compute the M1 money supply. This guide delves into the intricacies of calculating M1 money supply, exploring its components, and examining its significance in the financial realm. Join us as we embark on a journey to unravel the complexities of this crucial economic indicator.

Currency in circulation, demand deposits, and travelers’ checks form the foundation of M1 money supply. Understanding their roles and contributions is paramount in accurately computing this monetary aggregate. Moreover, the money creation process and factors influencing M1 money supply will be thoroughly examined, providing a comprehensive understanding of its dynamics.

M1 Money Supply: Using The Information Below Compute The M1 Money Supply.

M1 money supply is a measure of the most liquid monetary assets in an economy. It is a subset of the broader M2 money supply and consists of currency in circulation, demand deposits, and travelers’ checks.

Currency in Circulation

Currency in circulation refers to the physical banknotes and coins that are in the hands of the public. It is the most basic form of money and is widely accepted as a medium of exchange.

Demand Deposits

Demand deposits are funds held in checking accounts at banks or other financial institutions. They can be withdrawn or transferred at any time without prior notice. Demand deposits are a significant component of M1 money supply as they are used for everyday transactions.

Travelers’ Checks

Travelers’ checks are pre-paid checks that are used as a safe and convenient way to carry funds while traveling. They are not as widely accepted as currency or demand deposits but are still considered part of M1 money supply.

Money Creation Process

| Step | Action | Effect on M1 Money Supply |

|---|---|---|

| 1 | Bank receives a deposit | Increases |

| 2 | Bank lends out a portion of the deposit | Increases |

| 3 | Borrower uses the loan to make a purchase | Increases |

| 4 | Seller deposits the payment in their bank account | Increases |

Factors Affecting M1 Money Supply, Using the information below compute the m1 money supply.

- Central bank monetary policy

- Economic growth

- Inflation

- Interest rates

- Government spending

Importance of M1 Money Supply

M1 money supply is a key economic indicator that is closely monitored by central banks and policymakers. It provides insights into the liquidity and overall health of an economy.

Key Questions Answered

What is the significance of M1 money supply?

M1 money supply serves as a key economic indicator, reflecting the liquidity and spending power within an economy. It is closely monitored by central banks to assess monetary conditions and guide policy decisions.

How does the money creation process affect M1 money supply?

The money creation process, primarily through commercial bank lending, directly influences M1 money supply. When banks extend loans, they create new demand deposits, thereby increasing the overall M1 money supply.